Markets

US Stocks Markets Recorded Weekly Losses After Jobs Data

US Stocks Markets, regulators shut down Silicon Valley Bank after a run on deposits doomed the tech-focused lender’s plans to raise fresh capital. The bank’s parent, SVB Financial Group SIVB 0.00%increase; green up pointing triangle, is the largest U.S. financial institution to collapse since 2008.

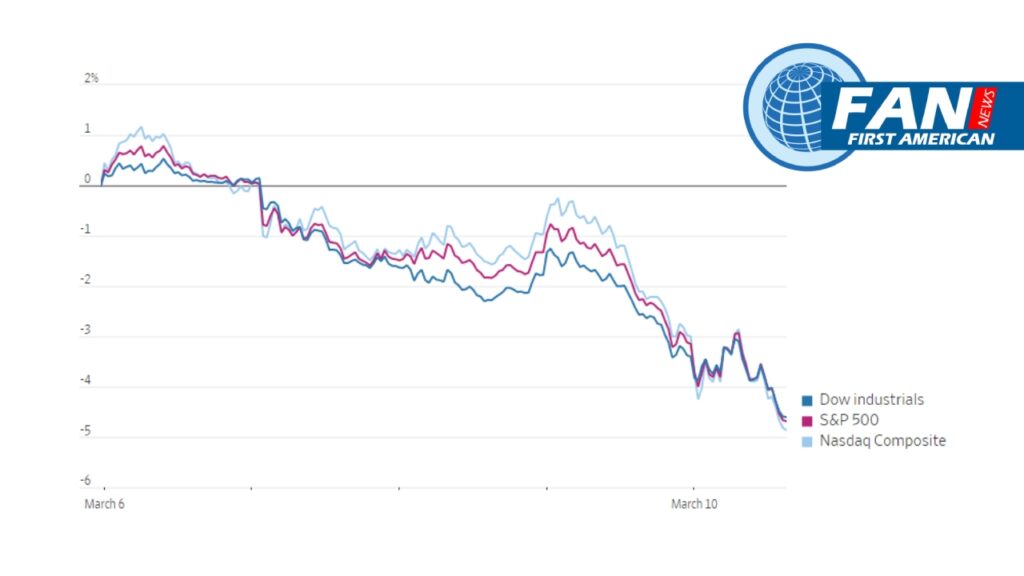

The S&P 500 declined 0.7%, while the blue-chip Dow Jones Industrial Average fell about 130 points or 0.4%. The Nasdaq Composite lost 0.9%. Investor sentiment has broadly soured in recent days, with the S&P 500 down nearly 4% on the week.

US Stocks Markets initially wavered after Friday’s jobs report offered mixed signals for the Federal Reserve’s efforts to tame inflation, then sold off broadly after the news of the bank collapse. All S&P 500 sectors were in the red in afternoon trading, as the broad-based index headed for its worst week since September.

Analysts warned of a bumpy ride ahead before Tuesday’s closely watched consumer inflation data is released.

“With the [headline] number coming in stronger than expectations, investors can expect equity markets to react negatively…since it increases the likelihood of a more hawkish Fed,” said Venu Krishna, head of U.S. equity strategy at Barclays. “With the persistence of strong readings, equity markets will brace themselves for the ‘higher for longer’ rates scenario.”

Get The Economist Epaper Digital 3-Year Subscription for $95

Still, wage growth was below expectations, and the unemployment rate ticked higher. Since wage growth is a major contributor to inflation, investors have been looking for a slowdown in the labor market that would allow the Fed to ease its pace of rate increases.

Art Hogan, the chief market strategist at B Riley Wealth Management, said shortly after the release that Friday’s report “may impact how much the Fed has to hike at its next meeting.”

Treasury yields tumbled after the report, an indication that investors are adjusting their rate-increase expectations lower. The yield on the 2-year note dropped 0.28 percentage points to 4.616%, headed for its largest 2-day decline since 2008.

Lower yields can also mean investors are running for cover to safer assets. Bond yields fall as prices rise.

Major U.S. banks had already lost billions in market value on Thursday after SVB’s troubles first prompted broader concerns about the health of the financial sector.

Trading of SVB shares was halted Friday morning after a 68% premarket selloff that came as the bank rushed to raise fresh capital. SVB said it had lost nearly $2 billion after being forced to sell assets to cover deposit withdrawals. The attempted capital raise failed, and by midday, the Federal Deposit Insurance Corp. said it had taken control.

Markets sold off across the globe Friday with investors rattled by the bank concerns. Several banks were among the worst performers in the US Stocks Markets, including PacWest Bancorp, Western Alliance Bancorp and First Republic Bank, which all plunged more than 20%.

SVB’s woes have highlighted the consequence of rising interest rates for some lenders. Rising rates have led to a slump in bond prices, meaning many banks that hold large quantities of bonds are sitting on large unrealized losses.

Get WSJ Print Subscription Delivery 6-days a week for $318

The issue spotlights the broader impact the Fed’s interest-rate increases are having on the economy and banks in particular, said Altaf Kassam, head of the investment strategy and research for Europe, the Middle East, and Africa at State Street Global Advisors.

“The broader worry is that not just Silicon Valley Bank but that in the broader economy banks lent a lot in the good times when rates were so low, which as rates have now risen so dramatically, is going to come back to haunt them,” he said.

Those concerns were showing signs of spreading overseas Friday. Deutsche Bank, Société Générale, and Credit Suisse all fell at least 4%.

“The knee-jerk reaction in the market to this risk event looks overdone, in our view,” said Mark Haefele, chief investment officer at UBS Global Wealth Management, in a note to clients. “But rising costs of deposits and possible deposit withdrawals are likely to pressure sector earnings.”

Overseas, the pan-continental Stoxx Europe 600 fell 1.4%. In Hong Kong, the Hang Seng Index fell 3%, while in Japan the Nikkei 225 declined 1.7%. China’s Shanghai Composite Index fell 1.4%.

In commodity markets, Brent crude, the international oil benchmark, rose 1.4% to $82.76.

Corrections & Amplifications

Western Alliance Bancorp was one of several banks whose stocks plunged more than 20%. An earlier version of this article misspelled the company name as Western Alliance Bancorp. (Corrected on March 10)